The Cyprus’ Property market

SALES

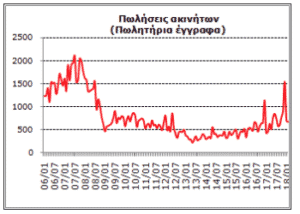

Property sales are booming in the first 8 months of 2018, according to figures released by the Land Registry, showing the rapid growth of the land market.

Danos an Alliance Member of BNP Paribas Real Estate

An important factor that has influenced the domestic real estate market and the real estate market is foreign investors, as well as the improved economic climate coupled with government tax measures, mainly the naturalization plan, significantly increase property sales, while the relaxation of criteria by banks for lending. In 2018, the upward course of development that began in 2017 will continue throughout Cyprus, particularly in the coastal areas.

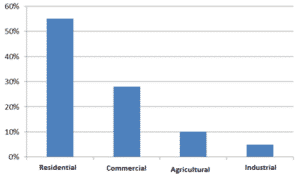

Property Investment in Cyprus by Sector

The Cyprus real estate market has historically been divided into the major urban centers of Nicosia, Limassol and Larnaca and the seaside resort areas of Paphos and Famagusta. Traditionally, the Cyprus property market is dominated by the residential sector, with the island’s geography and historical reasons partly dictating the dynamics of the various submarkets. However, the trend of development companies in recent years in the construction of office facilities intended mainly to the multinational companies which the island attracts.

Danos an Alliance Member of BNP Paribas Real Estate

Residential Market

An increase in sales of residential properties in all Districts has been recorded during the first 8 months of 2018. The level of Demand is higher to ‘end products’ rather than fields.

The main interest in buying residential products is coming from foreigners who choose Cyprus for the purchase of their second/holiday home or investors, who are taking advantage of the incentives given by the government to obtain a passport, mainly buy residential products (apartments, houses) in the coastal areas or in prime locations in Nicosia.

Prices of residential real estate for the first 8 months of 2018 have slightly increased.

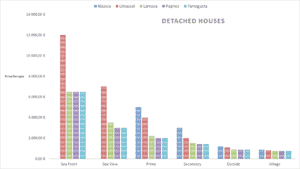

Prices of Residential Sector – 1st 8 months 2018

Characteristics: Independent house with high quality materials, up to 5 years old.

Danos an Alliance Member of BNP Paribas Real Estate

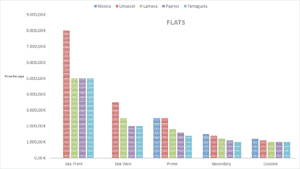

Characteristics: Flats with high quality materials, up to 5 years old.

Danos an Alliance Member of BNP Paribas Real Estate

Retail Market

Retail development concentrates in the 4 main cities (Nicosia, Limassol, Larnaca, Paphos).

Over the 1st 8 months of 2018, the occupancy in the major commercial roads has been increased. The main tenants are the clothing and footwear chains.

However, the attractiveness of the consumers by Malls or Department stores is still in high levels due to the fact that the consumers are attracted by the more convenient conditions to do their shopping combined with entertainment and fun. The convenience of easy parking, accessible to all climatic conditions, makes a visit to a single spot where one finds shopping entertainment and eating out under one roof, make malls the ideal place suitable for all ages.

Retail Markets- Rentals 1st 8 months of 2018

|

Street |

City |

Rent price sq.m/month (€) |

|

Arhiepiskopou Makariou |

|

20-25 |

|

Stasikratous |

Nicosia |

20-25 |

|

Ledras |

|

30-35 |

|

Anexartisias |

Limassol |

20-40 |

Danos an Alliance Member of BNP Paribas Real Estate

Office Market

During the 1st 8 months of 2018, the office market in Cyprus appears to be stable.

In 2018, Grade A offices show a particular demand for rent, the investment return is between of 5.5% – 6%. Organization such as the IRIS, the Agents Association, EAC, Ministries, The Department of Registrar of Companies and others are actively looking to relocate their services to Class A office premises.

Industrial Market

The recovering of the supply market lead to a positive development in the 1st 8 months of 2018. The industrial and logistics market is under investigation by companies related to energy, wholesaling and transportation.

PREDICTING THE FUTURE

The next decade will be different from the cycles of the last three decades. Most economists predict moderate, but stable demand growth. The technology revolution is similar in opportunity and employment impact to the industrial revolution, but the major difference is that we now have a global economy instead of a national economy, and the magnitude of economic growth may be substantially greater than the past.

What will “The New Economy” mean to real estate? The technology revolution (note that we will soon enter the space revolution) has actually created more employment opportunities and the need for more space of many types. Technology employment has created major demand for office space, more efficient inventory control has caused demand for large warehouse space, land based retail continues to grow as people have more money to spend and apartments are in large demand from the young people. People still need real estate to work, sleep, shop, eat and play.

The supply of space will be much more constrained than previous cycles for a number of reasons. First, the constraints on building have increased. Over the past two decades, the number of impact studies, permits and approvals necessary to build projects have more than tripled in cost and time. Environmental impact studies, traffic impact studies, storm water runoff management and other societal impacts must now be analyzed and mitigated before development approvals are given. The cost of construction labor and materials has increased at high rates. A “start-up” development company is now much more difficult than it was in previous cycles and many of the major commercial developers have become long-time investors by turning their companies into REITs. Also now, is much more difficult to justify new space without an analysis of existing competitive construction and user demand for existing space.

Millennials are creating a new dynamic in the real estate market. They are much more likely to rent, to congregate in urban areas, and to be cautious when taking on debt.

The purchasing and lifestyle habits of millennials shape also the real estate market economy.

The millennial generation favors renting over buying property for a number of reasons. They wait to commit to homes; desire to live in trendier, more expensive areas; or want the freedom to pick up and go with relative ease. A Millennials don’t feel ready to manage a property and prefer having a landlord to take care of maintenance issues.

MILLENNIALS SEARCH FOR THEMSELVES: Almost all Millennials still use a real estate agent or broker to purchase a home, but they prioritize those with websites that include photos, interactive maps, and detailed home information.

MILLENNIALS SEEK OUT SMALL, EFFICIENT SPACES: Many millennials like the ideals of minimalist living—fewer possessions and smaller spaces—because it provides them with the flexibility and financial stability they crave. Similarly, they also value energy-efficient appliances to help keep their bills and carbon footprints low. Millennials are comfortable in small spaces because they see their living quarters as a home base, not necessarily where they want to spend all their time.

Millennials don’t take a loan to buy real estate for investment or even for holidays or work. They see immovable property as a need, rather than as a valuable asset worth risking money.

—CYPRUS REAL ESTATE: IS IT A GOOD INVESTMENT?—

Keep in mind that real estate is location and property specific, and just because there is a shortage in one area, does not mean this is true all over. In addition, supply and demand can vary among homes in different price ranges, so we may see a shortage of homes for sale in the €100,000 to €200,000 price range but an oversupply of homes for sale over €1,000,000. Valuers always been required to research and analyze market conditions in their appraisal assignments.

The Cyprus Real Estate Market is volatile at present, but is definitely a good place to invest for the future. There is a positive momentum and trend.